Step by step approach on tax payments in Cyprus

In accordance with the Cyprus Assessment and Collection of Taxes Law, payments to the Commissioner of Taxation can be done via the following 2 methods:

Method 1:

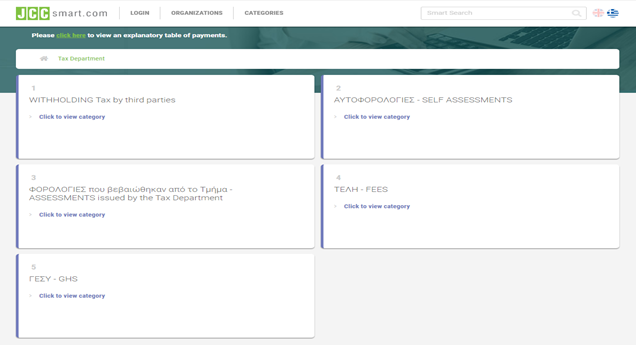

Via the webpage JCC Smart (https://www.JCCSmart.com) only when payments are within the deadline as specified by law for each type of tax. The steps are as follows:

- Login to JCC Smart

- Find the ‘Tax Department’ from Organisations

- Follow the relevant categories to insert the tax payment.

Example 1 – Payment of the Special Defence Contribution (SDC) on Rental Income by an individual:

An individual receives rental income from renting a house/apartment. As per the law s/he is oblidged to pay via self-assessment the SDC due. These steps are to be followed:

- Click on Self Assessments

- Click on Rents by the Owner (Self-Assessment) – (0604)

- Click on Defence on Rents (Self-Assessment by the owner – 0604)

- Fill in the required fields and proceed to payment

Method 2:

Via your internet bank using the Payment Reference Number that you can obtain when you create the liability using the Tax Portal of the Tax Department (https://taxportal.mof.gov.cy/) for payments that are within or after the deadline. The steps are as follows:

- Login to Tax portal, using your Taxisnet codes either as an individual or a company.

- From ‘My Account’ click on ‘Entry of Due Amount’ and choose the relevant tax code for which you wish to pay tax

- Fill in the fields required and click submit

- Return to Home Page and click on ‘Statement of Due Amounts’

- Click on the category to identify the specific instructions

- Use the fields ‘Total Due (€)’ and the ‘Payment Reference Code’ in your internet banking to pay the tax.

For further reference you can follow the Guide from the Tax Department.